blog

all quiet in the energy space

and it's been this way for weeks

Hondo Lane | July 27, 2020

Highlights

(Petrolytics) - All is eerily quiet in the energy space. And while natural gas prices recovered from an early week decline, both gas and crude closed within a pretty tight range. In any case, the key highlights to begin this week:

Oil & Gas Weekly Stats

- WTI open: $41.26/bbl

- Brent open: $43.35/bbl

- Natural gas open: $1.80/Mmbtu

- Crude oil refining -103 kbopd to 14.2 mmbopd (week of 7/17)

- US crude oil imports +373 kbopd to 5.9 mmbopd (week of 7/17)

- US commercial crude inventories + 4.9 mmbbl to 536.6 mmbbl

- US active oil rigs +1 to 181

- US active gas rigs 0-3 to 68

- Int'l active rigs -24 to 781 (Canada is + 10 to 42; big jump)

- US active frac spreads +13 to 80

Renewables Weekly Stats

- ExxonMobil collaborates on discovery of carbon capture enhancement - The company, along with UC Berkeley and Lawrence Berkeley National Labs have discovered a new material that could capture 90% of CO2 emitted from industrial sources

- Opinion piece on India revisiting the National Renewable Energy Policy

- Goldman Sachs takes over solar project - First Solar announced the acquisition of the 123MW AC American Kings Solar project in California.

- Cobalt: $12.93/lb

- Lithium carbonate: $3.29/lb

- Nickel: $6.11/lb

- Solar photovoltaic module: $0.21/peak watt

- Uranium: $32.90/lb

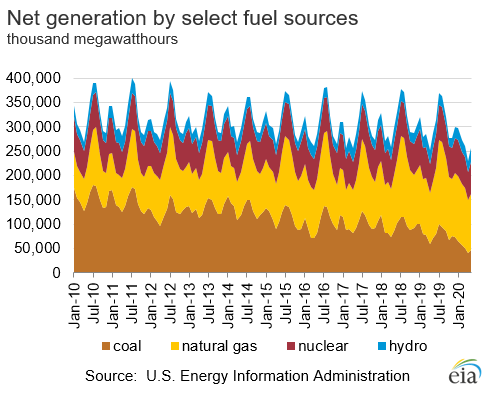

Electric Power Energy Source

Earnings

In case you missed it, many oilfield services companies released Q2 earnings last week; including Schlumberger, Halliburton, and Baker Hughes. Similarly, a number of high-profile E&P's are set to disclose this week. Among these are:

- Shell - July 30 before market open

- Total - July 30

- ExxonMobil - July 31 before market open

- Chevron - July 31 before market open

- Eni - July 31

Looking forward to the next few weeks are renewable energy earnings. These include:

- SunPower Corp – August 5 before market open

- First Solar, Inc – August 6, after market close

- Brookefield Renewable Partners – August 7 before market open

While the office 10-Q filings aren't typically available for a few weeks post-earnings release, we can still glean interesting data. For example, we're interested in CARES Act benefits and layoffs. While Baker Hughes noted a $75 MM benefit, they also reported significant layoffs. This in contrast with the Halliburton and Schlumberger filings; neither of these two firms reported a benefit. Schlumberger, however, did announce a significant 21,000 jobs-cut.

Have a great Monday, and stay safe.