blog

another day, another major writing-down assets

opportune timing to say the least

Hondo Lane | July 07, 2020

(Petrolytics) - Another day, another major writing-down assets. This go around, it's Eni. We'd expect a deluge of impairments given the opportune timing. If one is going to write-down under-performing assets, now is the time to do it. Everyone is expecting bad news; and if there's anything that shields a company from investor scorn, it's releasing poor guidance when everyone else is doing the same.

Keep in mind one can't just easily reverse a write-down. Reserves reporting is incredibly strict. One has to have reasonable expectation that asset value won't return in the short-medium term. Put simply, these impairments aren't just because of COVID. More than likely, they're a long-time coming and the timing is just too good to pass up.

Also, we spoke yesterday about investors requesting from E&P's their internal price forecasts. To reiterate our opposition - it's not necessary. There's a reason proved reserves exists. These are volumes that can be recovered with a reasonable level of certainty and they're assessed with an SEC-mandated discount rate and price protocol. So... the price is known!

Anyway, here're are a few more interesting articles for this morning:

- Rystad Energy's take on the impact of a second COVID wave - slightly off phase given Dr. Fauci (for what it's worth) considers us to still be in the first wave.

- What does net-zero look like for miners - it appears to us there's an illusion that net-zero carbon means zero negative externalities. What's the impact to our environment from mining enough material to supply hundreds of millions of car batteries and thousands of wind turbines? We need to be cautious that our catharsis isn't taking priority over other considerations (e.g. cheap energy, economics, environment, etc).

- Good article on impairment testing - "For unproved properties, companies use qualitative factors and recognize the loss with a valuation allowance."

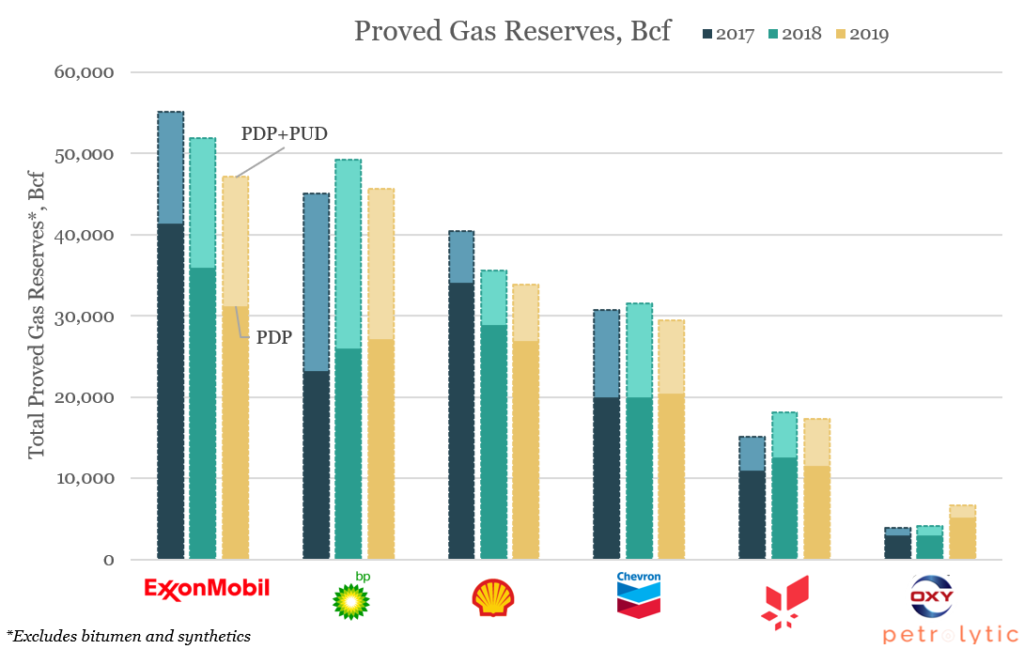

In celebration of upcoming earnings, we're going to start including food-for-thought graphics to get you warmed-up. We shared on Twitter yesterday a plot of proved oil reserves by major operator. We've included that below.

Similarly, we've included in the header-image (and also below) the proved gas reserves by operator. A few things to note:

- Exxon has significant bitumen and synthetic oil proved reserves. They're not included here

- Shell lumps natural gas liquids (NGL) in with their crude oil reserves. This is sneaky. NGLs are lighter condensate (less of the heavy carbon molecules) and aren't as valuable as crude.

That wraps things up. Stay safe!