blog

chevron acquires noble energy

and it's big news

Hondo Lane | July 21, 2020

(Petrolytics) - Big news yesterday as Chevron announced the acquisition of Noble Energy for $5 billion in an all-stock deal ($10.38 per share). The total enterprise value is expected to be $13 billion, including debt.

This marks the first major M&A deal of the COVID-era, and we would expect is the first of many. And while Chevron CEO Wirth points out the Noble assets "are high quality assets at a very fair price", Noble probably had no other option. Generally speaking, it's not really a seller's market. Below are just a few of the recent Noble asset sales:

In any case, Chevron will be adding assets to both their extensive domestic and international portfolio. These include (from the press release):

-

U.S. onshore

- DJ Basin – New unconventional position with competitive returns that can be further developed leveraging Chevron’s proven factory-model approach.

- Permian Basin – Complementary acreage that enhances Chevron’s strong position in the Delaware Basin.

- Other – An integrated midstream business and an established position in the Eagle Ford.

-

International

- Israel – Large-scale, producing Eastern Mediterranean position that diversifies Chevron’s portfolio and is expected to generate strong returns and cash flow with low capital requirements.

- West Africa – Strong position in Equatorial Guinea with further growth opportunities.

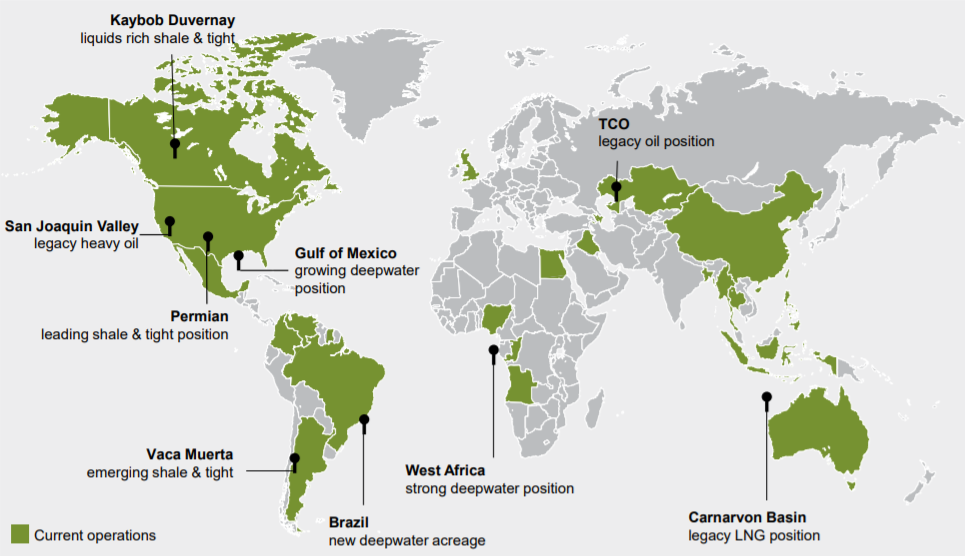

Chevron's operations as of May 2020 (from May investor briefing)

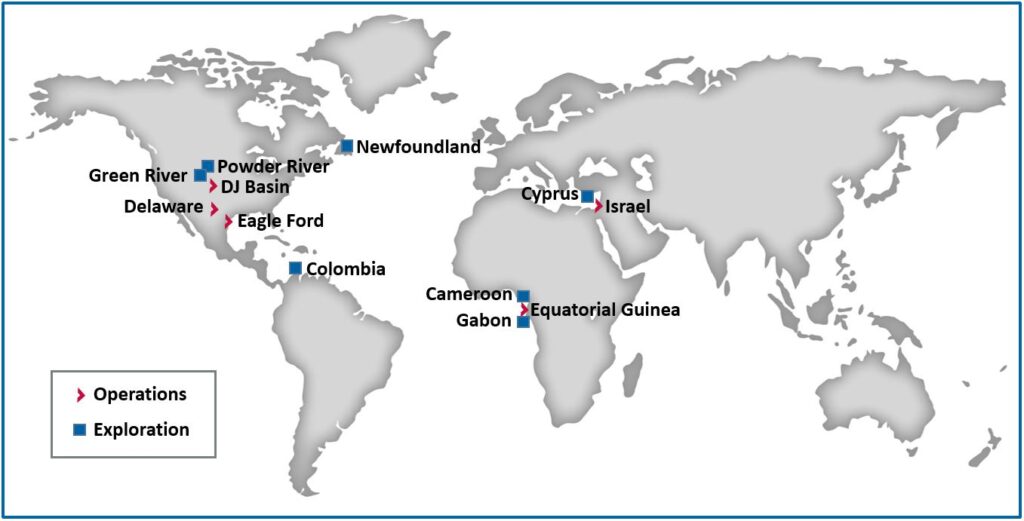

Noble Energy's operations as of February 2020 (from 2019 10-K)

Furthermore, Chevron looks to add a non-trivial amount of proved developed and proved undeveloped reserves. Among this volume is Leviathan, the sizable gas field in the Eastern Mediterranean which came online last December and accounts for >15% of Noble's proved reserves.

Total liquids and gas production in 2019 for Chevron and Noble was 1.9 mmbopd and 7.1 bcfpd and 0.21 mmbopd and 0.92 bcfpd, respectively. If only we could've been a fly on the wall in the Chevron boardroom; the past year has been quite a doozy with Oxy's Anadarko debacle.

We'll wrap up with a few interesting links for the day:

- EIA short-term demand forecast - US demand is predicted to stay below 2019 levels until Aug 2021

- Large inventory of wells to P&A - study indicates significant labor requirement to P&A orphaned wells; we're curious as to what constitutes an "orphaned well" here. Are these temporarily shut-in stripper wells?

- Shale impairments ...again - is this the capitulation we need for a healthy industry reset?

That's it from us for today. Stay safe.