blog

halliburton and baker hughes

kickin' off earnings

Hondo Lane | July 23, 2020

(Petrolytic) - Earnings season is upon us. And this isn't any ol' normal earnings season. This is COVID earnings season; where the models (seriously) don't work and no one has a clue what's coming next. We think it's prudent to take a step back and assess the context clues put forth in the management discussion and analysis (MDA) and footnotes. Unfortunately, while the 8-Ks are available for review, the more comprehensive 10-Qs aren't typically publicly available for a few weeks after filing (a firm has ~40 days to file after the reporting date).

At any rate, it's nothing to fuss over. We wanted to take this time to summarize a few higher profile energy sector players.

Halliburton

- Net loss of $1.7 billion (B) vs net loss of $1.0B in Q1 2020

- Net revenue down 37% from Q1 2020 to $3.2 B

- Operating loss of $1.9B vs operating loss of $571 MM in Q1 2020

- $456 MM free cash flow (FCF)

- $2.1B impairment

- Furloughed 3,500 Houston employees in March

Halliburton took an unsurprising hit due to a reduction in drilling and completion activities, as well as, lower international software sales. North America revenue suffered the biggest blow (-57%), while the Middle East and Asia stood relatively resilient in terms of revenue decline at -10% (partially offset by activity/tool sales in China and Kuwait).

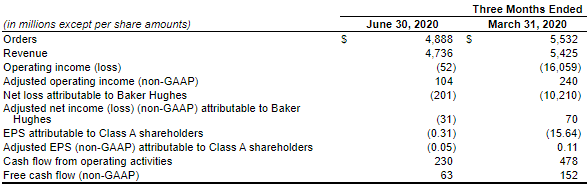

Baker Hughes

- Net loss of $200 MM vs net loss of $10.2B in Q1 2020

- Net revenue down 13% from Q1 2020 to $4.7 B

- Operating loss of $52 MM vs operating loss of $16B in Q1 2020

- $63 MM free cash flow (FCF)

- $75 MM benefit related to the CARES Act

- $100 MM impairment

BKR appears to have stacked the bad news in the Q1 2020 filing. Lorenzo Simonelli (CEO) believes that while "economic activity likely troughed during the second quarter", there still remains an "extremely limited" outlook (due to a second wave of virus cases, lockdowns, and high unemployment).

BKR highlights remote working and the ability to conduct remote operations. The firm also indicates a potential savings of 20,000 tons of CO2 equivalent per year as a result of the Turbomachinery & Process Solutions (TPS) compressor test campaign. Interestingly enough, revenue for all services was down, except for TPS, which registered an approximately $80MM increase from Q1 2020.

Wrap-up

Halliburton and Baker appear to have different strategies going into the Q2 filing. Where Baker front-loaded the losses in Q1, Hallburton did not. What's even more interesting is Baker's signaling of CO2 measurements (via TPS testing) and receiving of CARES act benefits. Not concluding anything here. Just an observation. Perhaps CO2 disclosure will become more frequent (most likely). Also, is a CARES benefit a required disclosure? If so, we're curious to see who else benefited from the stimulus, and if they did, were staff spared layoffs?

Finally, a few interesting links for the morning:

That about does it for us this morning. Hope everyone stays safe.