blog

preparing for energy earnings season

hold on to your pants

Hondo Lane | July 17, 2020

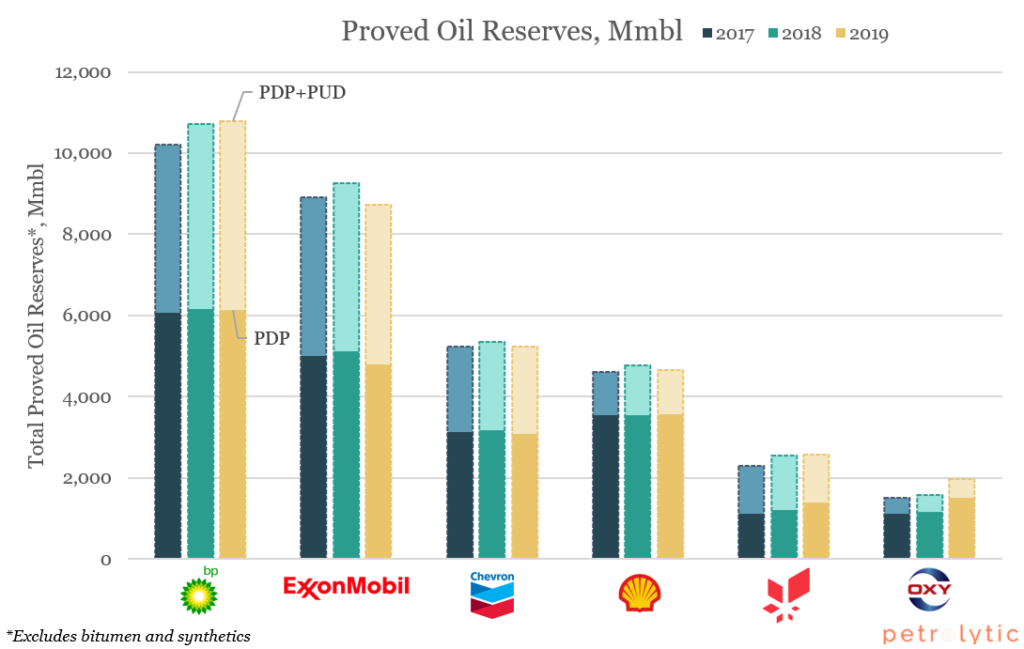

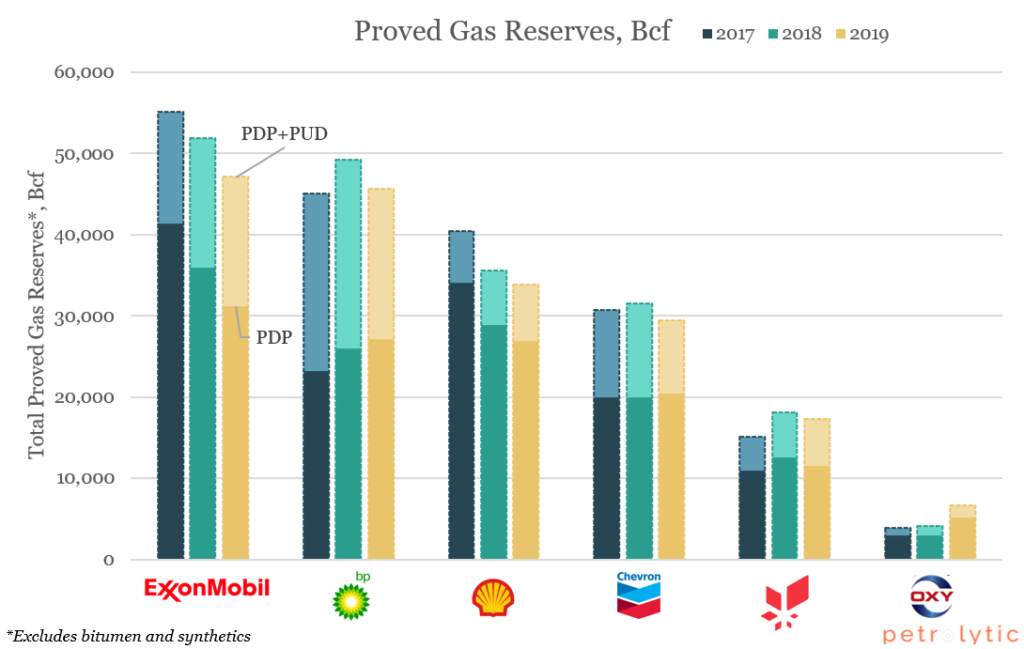

(Petrolytics) -As we drift into another season of oil and gas sector earnings, we'd like to take time over the next few posts to survey the lay of the land. That is, we'd like to review a few simple, but key elements of the larger players. Taking routine inventory of changes in production volumes, proved reserves, product mix, and other quantitative metrics provides valuable insight into the state of the industry.

Even more, studying the management notes in a more qualitative manner can provide a backdrop for these measurements. For example, the product mix (i.e. liquids and gas split in the prior image) can be interpreted as a leading indicator for sentiment toward a given product. While Exxon and Chevron exhibit a more balanced mix, Shell shows a heavy tendency toward gas and Oxy toward liquids.

Taking this a step further, assessing Shell's 20-F qualitatively, we can see that Shell lumps all liquid reserves together. More specifically, while most operators quantify natural gas liquids separately from crude oil (NGLs are a lighter, cheaper condensate associated with wet gas production), Shell doesn't make this distinction. Given gas and liquefied natural gas prices (LNG) are less attractive, perhaps Shell is attempting to beef up their optics. It's imperative to realize that not all liquids are created equal. This is equally important when assessing barrels of oil equivalent (BOE) numbers. In our opinion, BOEs are an almost worthless, deceptive metric used to inflate reserves numbers.

In any case, stay tuned for earnings later this month and our assessments of the key players' results.

Before we break for the weekend, a few links we found interesting:

- Bold OilPrice.com call on oil price forecasts - no one has a clue what will happen; there's too much uncertainty. We lean toward Taleb's opinion that hedging against tail risk is important during these times.

- Oil majors set carbon targets

- Petrobras recent asset sale stats

- This company makes masks that look like your face

Tune in for the upcoming assessment of energy sector earnings. We'll provide a simple and concise review of select companies. And as always, stay safe and have a great weekend.