blog

recovering from colossal impairments

$90 billion dollars worth

Hondo Lane | August 13, 2020

(Petrolytics) - $90 billion dollars. Thirteen of the top oil and gas operators have written-down $90 billion dollars in value so far in 2020. One might discard this as a one-off event related to the COVID pandemic. We don't buy it. Sure, COVID has had some impact, but we think this impact is in the form of opportune timing. Announcing to the public bad news isn't so bad when everyone else is in the same boat.

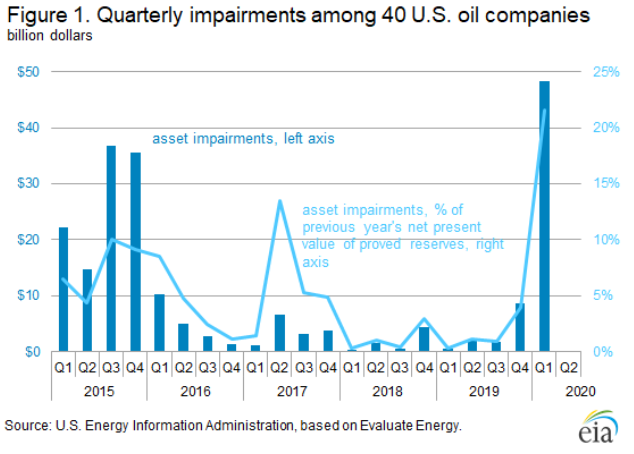

Our memory is short. We need to look back only a few months to see that these impairments were bound to happen eventually. Chevron wrote down $10B in Q4 2019, while Shell impaired $2B. Even more, are the undoubtedly massive private equity charges. The EIA even compiled a timeline through Q1 2020 of 40 oil companies' (with notable exclusions) asset impairments.

What is the point of writing down these assets? Does it even matter? Will they continue to impair assets? Obviously the companies believe they're less valuable, however, we believe there's something more nefarious going on; that is, these companies have blatantly mismanaged capital and are blaming opportune crises. It's become apparent that global growth rates are slowing and real returns are shrinking, more or less, across the board. The shift toward ESG is less virtuous than it seems; more an illusion to condition investors to exchange lower returns for social causes. Ambiguous performance metrics rooted in global well-being are less quantitative than strict financial goals, and only further complicate the principal-agent problem. We're entering an interesting time where financial and technical performance might not matter as much anymore. This is worrisome as what's more beneficial to prosperity than creating wealth and jobs for a community? We're skeptical of it all.

Look, we're sympathetic to the forecasting efforts. Predicting well performance, particularly unconventional production performance, is very difficult. Add on the mounting executive pressure to beef up type curves and production profiles. One can only kick the can for so long. (Un)fortunately, the can was kicked into the hands of COVID.

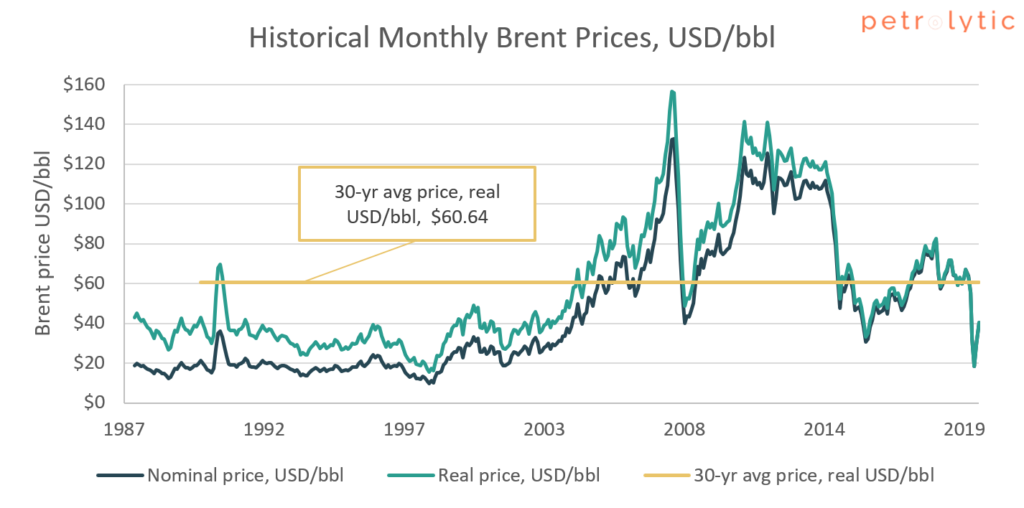

It's the perfect excuse. A pandemic and low oil prices were gifts. Even more, these firms forecast, what they call, lower for longer oil price: $60/bbl. Wow! So low. But wait. The average real oil price for the previous 30 years was $60/bbl. This lower for longer oil price assumption is meaningless, and honestly, misleading.

Is there more to come? Probably. Exxon anticipates writing-down 20% of their proved reserves, and Chevron expects to write-down 10% of their proved reserves. Not all is bad news, however, as firms are able to borrow at much lower rates these days. These low borrowing costs effectively allow a firm to refinance previous debt. So while oil price is similar to levels in 2015-2016, rates are much lower. This should help companies out quite a bit.

In any case, if Q1 and Q2 are any indication, everyone will try to impair their assets this year. And while Exxon has held out for as long as they can, they'll probably write-down XTO to some extent. Why not? Everyone's doing it.