blog

the staggering losses and the relative resilience

energy earnings galore

Hondo Lane | August 11, 2020

Highlights

(Petrolytic) - Last week ended the bulk of Q2 2020 earnings for the energy sector (although Oxy reports today). Renewable firms demonstrated relative resilience, while oil and gas operators suffered staggering losses. And although the** Big Oil financials** were abysmal, unlike oilfield services earnings the results were at least surprising.

We'll provide a quick summary of a few firms in the sections below.

Oil & Gas Weekly Stats

- WTI open: $41.50/bbl

- Brent open: $44.66/bbl

- Natural gas open: $2.26/Mmbtu

- Crude oil refining +42 kbopd to 14.6 mmbopd (week of 7/31)

- US crude oil imports +900 kbopd to 6 mmbopd (week of 7/31)

- US commercial crude inventories -7.4 mmbbl to 518.6 mmbbl(week of 7/31)

- US active oil rigs -4 to 176

- US active gas rigs remained steady at 69

- Int'l active rigs -38 to 743 (Canada +2 to 47)

- US active frac spreads -6 to 70

- ExxonMobil suspends employee retirement plan contributions (Surprise! This wasn't included in the Q2 press release or 10-Q.)

- ExxonMobil expects a ~20% downward revision to proved reserves

- Chevron anticipates a ~10% downward revision to proved reserves

Renewables Weekly Stats

- Cobalt: $15.01/lb

- Copper: $2.92/lb

- Lithium carbonate: $3.29/lb

- Nickel: $6.50/lb

- Solar photovoltaic module: $0.21/peak watt

- Uranium: $32.95/lb

- China dominates bid for largest African dam

- First semi-submersible wind farm is now operational

- SMUD overpaying rooftop solar customers, study finds

Earnings

In case you missed them, we've summarized below the notable earnings from last week.

Diamondback - Aug 3

- Net loss of $2.4B

- $2.5B in impairment charges

- Trialing 25% recycled water fracs

- Drilled 8,150' lateral in 24 hrs with new rotary steerable tech (Permian Basin record)

- Flaring down to 0.3% of net production

- Drilled 58 horizontal wells (15 put-online)

- Anticipates 5-6 active drilling rigs and 3-4 frac spreads for 2H 2020

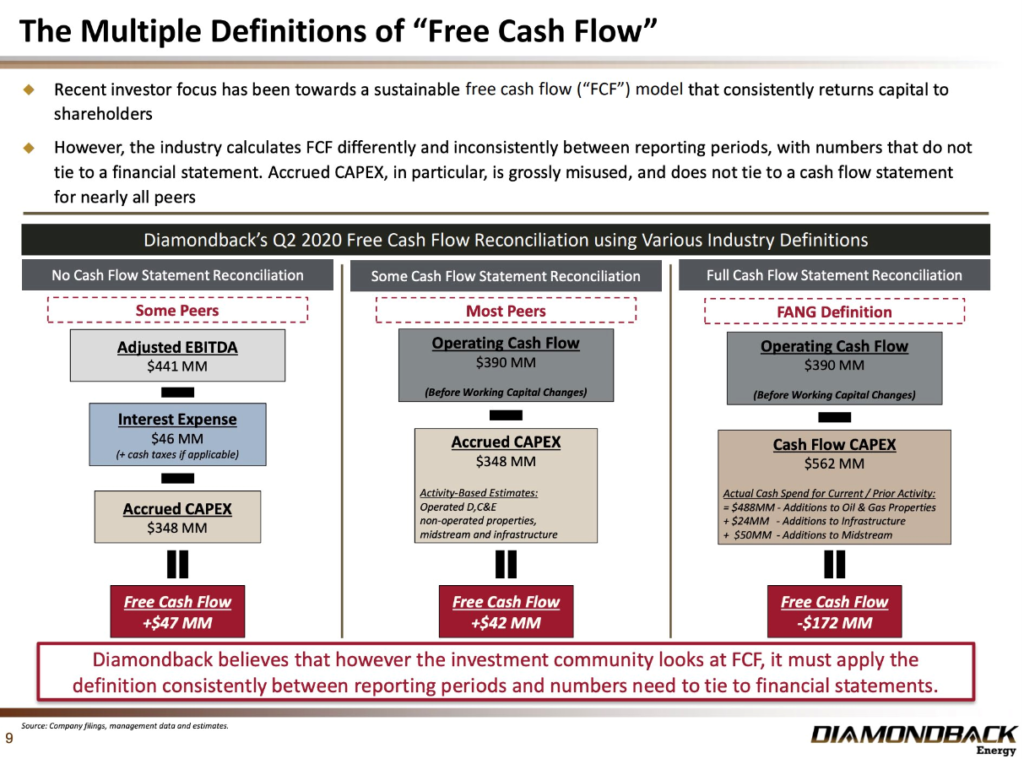

- Illustrated frustration with various accounting methods used across industry - slide included below:

EOG - Aug 6

- Net loss of $909 million

- $305 million in impairment charges ($1.8B YTD)

- Economically shut-in production of 73,000 bopd during Q2

- Anticipates 25,000 bopd will remain shut-in

- Deferred initial production from most new wells to June

- 500 BCF net natural gas discovered in shallow water Trinidad

- $3B reduction in revised 2020 capital budget to $3.5B

- 10 net wells POL in Q2 2020 vs 500 net wells planned in 2020

BP - Aug 4

- Net loss of $16.8B

- $10.9B in impairment charges

- $6.6B capital expenditures in 1H 2020

- $12B in revised full year CAPEX

- Laying off 10,000 workers

-

Surprise: net zero carbon emission ambition by 2030

- No oil and gas exploration in new countries

- Reduce oil and gas production by 40%, or 1 Mmboepd Invest $5B/year in low carbon investment

It's no surprise that integrated oil companies have been slowly pivoting to become integrated energy companies for decades. This issues, in our opinion, with BP is their gross mismanagement of oil and gas investments. How can they convince us that they'll be responsible stewards with renewables when they haven't demonstrated the same with oil and gas (when this is supposedly their forte)?

BP has some of the largest volumes of proved reserves. Eliminating these reserves by reducing production and eliminating exploration sets them up for M&A in the future. We commend them for the ambitious plan, but the skeptic in us says they're leaning on ESG to mask their poor performance (i.e. a distraction and illusion).

SunPower Corp

- Net income of $19 million

- Completed spin-off of Maxeon Solar Technologies

- 45,000 home backlog of new builds with OneRoof product

-

Expects net loss of $95-$110 million in Q3 2020

- Not much detail on guidance - perhaps separation costs associated with Maxeon spin-off ($60 million) + out of market polysilicon contract ($40 million)

- Capital Markets Day on Sept. 10, 2020

First Solar, Inc

- Net income of $37 million

- +$110 quarter-on-quarter net sales increase primarily due to American Kings divestment

- No material impact due to COVID

- $450-$550 million in full-year CAPEX guidance

-

0.80 GW of net bookings since Q1 2020 (2.6 GW YTD)

- 5.9 GW full year module production guidance

- 3.5 GW of YTD production

- Fleet-wide capacity utilization over 100%

- $6 million litigation loss due to Q1 class action lawsuit

Brookfield Renewable Partners

- Net income of $11 million

- Hydro funds from operations -15% (-$33 million) to $193 million in Q2; mostly due to lower generation in the US

- Wind funds from operations +23% (+$9 million) to $48 million due to cost reduction and refinancing

- Solar funds from operations +37% (+$10 million) to $37 million due to contributions from acquisitions and sales

- $85 net million proceeds YTD in "recycling activities" (marginal/mature projects divested)

- Agreed to $130 million net equity investment in 1,200 MW solar development in Brazil

Hope everyone enjoys their week. Follow us on Twitter for daily insights. We'll be back next week with another concise, but comprehensive weekly update.